For most online retailers, the route an order follows after the purchase is finished is very similar: the first thing that happens is the payment authorization, checking if the card is valid and if it has enough balance, then, anti-fraud, evaluating if the order can be shipped or if a manual analysis is required. At this point, many retailers also check the inventory to ensure the product is still there. If the risk analysis is OK, the retailer forwards the operation to handling and shipping. And that is it.

This flow is well-tested by many stores, and works well for those who sell products (physical) and depend on a carrier to collect and send them to the final destination. But what happens when the company hasn’t got that time to approve the purchase and ship the product to the client?

Here we are talking about businesses such as food delivery, online games or software sales, or even express delivery of products. In such cases, the operation has to work in real time and the answers must be precise and instantaneous: a gamer will not want to wait hours before testing that game he wants to download, and the starving client will not like to wait another minute for his order to reach his door.

“Your scrumptious pizza has left the oven, cheese is bubbling hot, and the pepperoni is crispy. But please hold on just a few more hours while we confirm your payment.”

Have you thought about it?

The store owner operating in these conditions doesn’t have the luxury of filtering the most difficult orders by hand, so he needs to choose: let more frauds slide and not cause an impact on legit clients or stop more sales and end up with good clients “caught on the net”?

What hurts more?

Here, it’s important to make a note: if the store owner is in this position of having to choose between selling more or stopping more, who must help him in the decision is his pocket – or the “pain felt in the pocket”. If the business model is sustained in larger margins, maybe the best answer is to approve more orders, since the loss will be much lower – although there is still the risk of fraud volume being so big as to bother the credit card owners. If the store owner works with scale or high-cost physical products, denying suspected sales can be the smartest thing to do.

We know, the term deny sales generates a great discomfort to store owners – and such reaction is totally understandable. It is income that does not come in, a target that is not met, a product that remains in the inventory… it’s a bad feeling, especially due to the doubt of not knowing if that order denied would have been a good order. However, it’s necessary to be aware that not always “denying a sale” means “refusing to make money”. Sometimes, it may mean refusing a fraud. This is about keeping your business healthy and avoiding a (huge!) loss.

However, there is a “mid-term” between denying a fraud and losing a good order just because it seemed fraudulent. This is an authentication backup: a kind of “second chance” to authenticate that sale, requesting some type of confirmation from the client before releasing the order. For instance, in the case of a delivery service, inform that the payment will only be accepted for transactions with the physical card (with the machine taken by the delivery man), or requesting a token sent by Text Messaging before considering such payment approved. Yes, it is another step in closing the deal and we know the implications that this may cause to the sales funnel flow, but you were already refusing that sale, weren’t you?

Anyway, the company can’t be limited to the traditional fraud-blocking tools. There are many other data that must be taken into consideration in order to detect a fraudulent purchase – and these data say a lot. And that is where two little problems are: some information isn’t “visible to the naked eye”; and the data need to be analyzed.

The power of artificial intelligence

Have you already detected patterns on the sales your e-commerce makes, both the legit and the fraudulent ones? If you analyze it carefully, study them thoroughly, you will see that several patterns are repeated for several types of transactions, performed by several types of consumers.

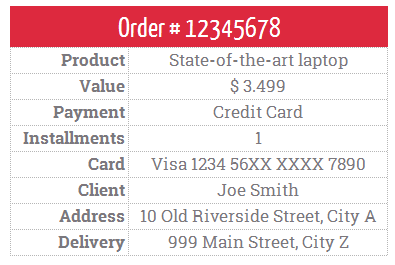

Maybe you are wary of a client who has never purchased electronic devices from your website, but who at this time purchased a laptop worth $ 3,499.00, paid it full and ordered to deliver it in a different city, on the other side of the country. Suspicious? Maybe.

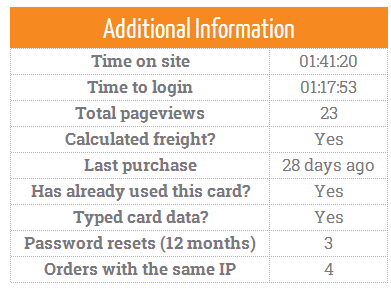

But what if he spent a whole hour on your site, looking into several models, placed and removed several items from the cart, calculated the freight and only then logged in to type all the numbers in the credit card? The risk gets lower, doesn’t it? Very well, because he only wished to send a birthday gift to his sister, who lives far from him.

Fraudsters would not waste so much time looking at products and calculating freight: they would simply pick the product they are interested in, put it into the cart and completed the purchase in a matter of minutes.

For instance, instead of looking only to the following order information:

You can also consider this:

A priori, with a good knowledge of maths and statistics, pen and paper (or an Excel spreadsheet) and plenty of time to invest, you can create the rules that work to avoid frauds in your online store. But make this model to be applied to all transactions and have the answers in real time render this task humanly impossible.

That is where artificial intelligence comes in. It is able to cross all information (and many others) in milliseconds, without jamming your business or leaving the starving customer waiting for that piping hot pizza. Without mentioning, with all this, that your costs with frauds decrease and your profits increase. So, how about ordering a pizza to celebrate?

About Konduto

We are a startup developing an innovative technology to bar e-commerce frauds. Our intelligent anti-fraud monitors the client throughout his purchase journey in your site and evaluates the transaction in real time – our answer is given in less than 1s! We detect only the purchases that are really suspicious, approving more orders and reducing the costs with frauds. Send us an e-mail on hi@konduto.com