I have recently received many e-mails and private messages from entrepreneurs asking why I always make the same question to sites that are struggling to service: what is the payment method used?

I suspect something. Or better: I’m sure of something. An almost absolute certainty: the best way to destroy small businesses on the internet is to bet on the wrong payment medium. Many people reading this post will ask me: “what would be a wrong payment medium?”. I answer in a simple and direct way: Any payment medium that approves less than 80% of the orders sent by your site is wrong!

Online entrepreneurs, ask yourselves: “from every 100 orders I send to my payment medium, how many are approved?”. Many will not know this answer, but I bet most e-commerces will know the acquisition cost of a client through sponsored links, what percentage of visitors become purchasers, etc. But why only a few, very few people will know the index of approved orders?

My answer encounters two possibilities.

The first one is simple: LAZYNESS

If you are in the position of thinking you do not need to know about payments only because you pay other companies to do that for you, know that your path will most likely be to the limbo of 404 pages from deactivated sites and bankrupt businesses!

While you believe you do not need to understand how to process your own payments, you will not be able to compete with your competitors who make an effort to learn about the subject! They will have a lower client-acquisition cost than yours (I will show this at the end of this text). And with time, your “fuel” and “financial health” will simply not be able to keep up with the most efficient sites in this matter.

The sites with better conversion for purchase orders are those that can even pay more to be in the first position in the searching engine rankings, for instance (after all, they have more cash in hand at the end of the day to perform these marketing actions).

The second possibility is a bit denser. It is related to the…

FEAR OF FRAUD

This argument seems to be very strong when you do not study a bit on the subject, and it is understandable. After all…

FRAUD IS SCARY!!!

It is true. You ask yourself: “how can I know if the sale is good or not?”, “and if this order with a three-fold higher value than my average ticket was made by a fraudster?”

I have some bad news for you, my friend:

Fraud is a continuous act!

I can assure you that there will always be someone wanting to take advantage of others: whether it is that person that takes a bar of chocolate from the supermarket shelf and eats it right there, the store owner who does not calibrate his scales properly and at the end of the year has made a small fortune with it, the taxi driver who takes a “better” (and much longer) route, the sites that hide service taxes and abusive freights, etc.

Anything with the purpose of misleading others may be considered a fraud. Now, if we are prepared to take a taxi, or if we create mechanisms that inhibit clients from making something stupid within our physical store, why are we so scared of online fraud?

Simply because we are not able to measure the problem. We cannot face it upfront. And the “online fraud monster” is hidden, unknown. And believe me: at the end, it seems to be the boggy man!

Try answering this question before reading on: what is the average for orders with attempted fraud in Brazil? What is the real average for frauds performed over the internet?

Just take a rough guess.

Fraud attempts in the e-commerce is 3.8%. Yes, you read it right: 3.8% of ALL e-commerce orders are considered pure frauds.

But how many orders in fact cause frauds to the electronic market? Evidently, this figure is even lower: something around 0.8%. I say”around” because there are few data available, and banks end up mixing even chargeback orders due to commercial non-compliance in this index – such as friendly fraud.

Analyzing the data I have been dealing with in the past nine years, I would say real fraud is around 0.8%. Again, you read it right: THE RATE IS LESS THAN 1%!

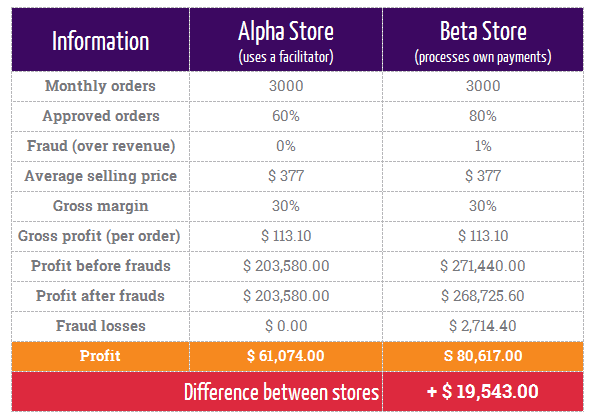

Let’s make a simple exercise with two scenarios, with two e-commerces: Alpha Store, using a “wrong” payment medium, and Beta Store, directly processing its payments. In order to ease understanding, let’s consider that both companies have identical characteristics in site browseability, prices and delivery conditions.

We have, therefore, two scenarios:

Is that it? Almost $20,000 difference in the monthly profit for each company? Almost $240,000 thousand per year?

Now tell me, which of the two stores will survive?

You can take as long as you need… 🙂

Jokes aside, only in December 2015, three site owners about to close the doors came to me for tips on how to reverse this disastrous conversion. For two of them, unfortunately, it was too late.

And for you? When will it be too late? When will you learn that, without evaluating the conversion of your payment system, you will know nothing? Can you do something before it is too late?

Before your financial health is over, think about it, make calculations and more importantly, make your choices.

About Konduto

We are a startup developing an innovative technology to bar e-commerce frauds. Our intelligent anti-fraud monitors the client throughout his purchase journey in your site and evaluates the transaction in real time – our answer is given in less than 1s! We detect only the purchases that are really suspicious, approving more orders and reducing the costs with frauds. Send us an e-mail on hi@konduto.com